Born on April 15, I was my parents’ little deduction. I'd like to think the date is circled on calendars or set as a reminder on cell phones across the country to celebrate my birth. But Uncle Sam has trumped me. I always try to finish my tax return before my day, because who wants to mix obligation with celebration? Render unto me what is my own; I don't share limelight well.

Of course, the IRS may be a little perturbed that my festivities take away from their deadline; I've noticed they sometimes change it by a day or so to indulge me and have their own 15 minutes of fame. That's nice.

Before the intrusive deadline, I psych myself up for the event. Knowing it will be weeks before I see my family again, I kiss Flash and Cowboy goodbye as I load up on comfort food and lock myself in my bedroom.

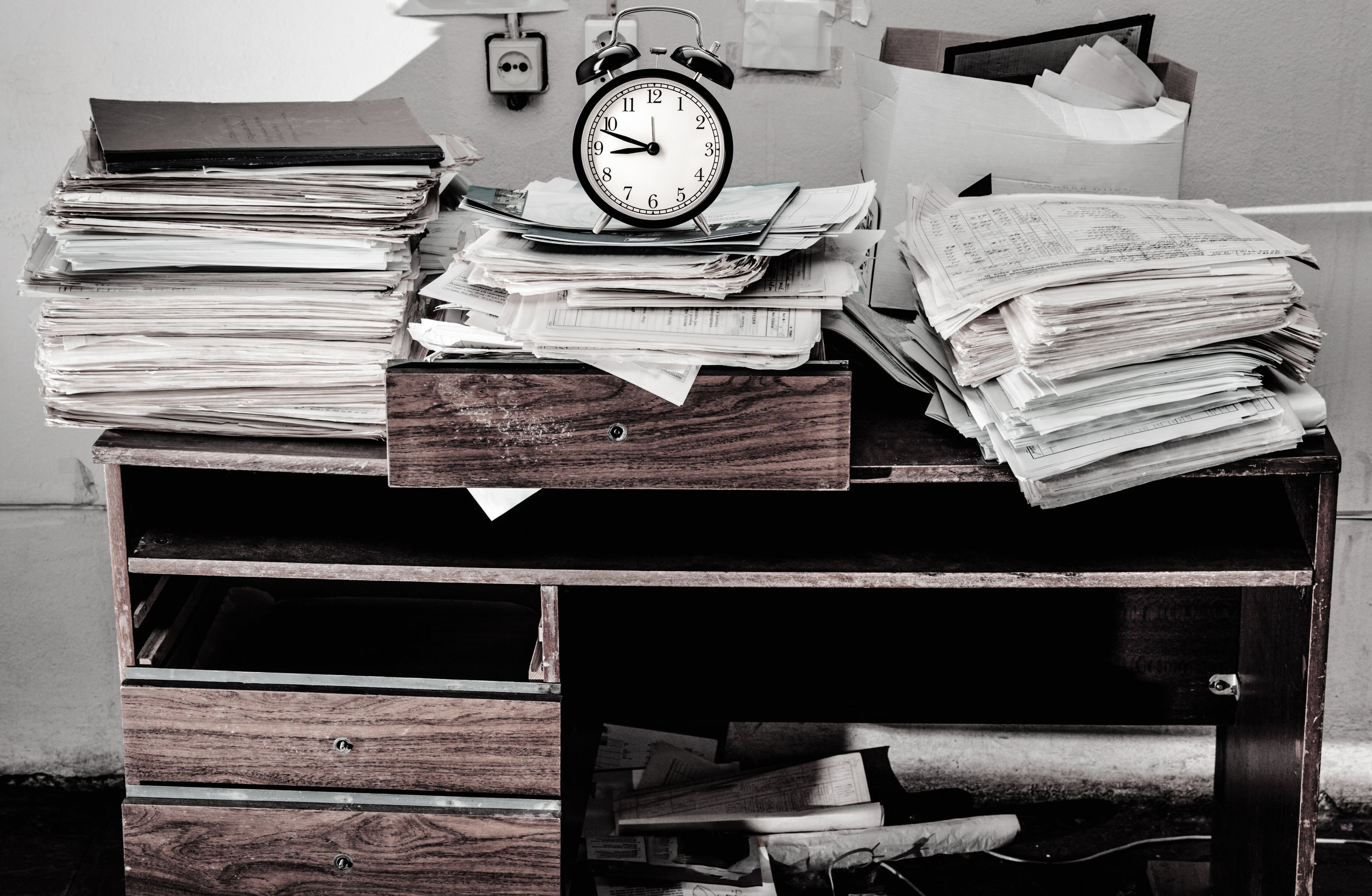

I begin my tax adventure by sifting through my things-I-should-file-throughout-the-year-but-never-will-because-life-is-too-short box, the cardboard box that sits under my bathroom counter all year. Last year, my goal was to transform the box into a tax-related-receipts-only box. But where would I have put all my what-if receipts? What if my new DVD had a scratch on it? What if my new sweater suddenly unraveled? What if "Guaranteed to work" was a big fat lie? I needed to save all my proof of purchases for what-if returns. As soon as you throw something out, you’ll need it, Dad’s words echoed in my head.

The vacuum cleaner, not yet a toddler, died unexpectedly a month after coming to live with us. Because the appliance could only be returned to the manufacturer, a receipt was required. Of course, only God Almighty knows where that proof of purchase resides. It may have been tossed in the trash when I saw “cabbage” and “toothpaste” listed on it, but I failed to see “vacuum.” Or it might have been dropped into the Blue Tote Bag of Miscellaneous Things to be Filed One Day, which is the same as being lost.

Yet I safely tucked away a receipt listing “paper towels,” “chips,” “dog food,” “toilet paper,” and “olives.” Just in case the toilet paper didn’t live up to our expectations. Because returning anything and everything is the norm in the retail world.

When I sold men’s clothing in the mid-80s, customers, usually women, came in to exchange or get refunds on anything they had purchased, including used swim trunks. Faded, threadbare, probably-not-washed-before-returning-them swim trunks. I shudder to think. We were required to accept them back. It was “free refills for life” in the Men’s Department. The reasons didn’t matter – perhaps they didn’t fit anymore because the elastic was shot.

But I was raised with guidelines such as the once-you-buy-a-pair-of-shoes-and-wear-them-it’s-too-late-to-return-them rule. Which explains why I insist Cowboy walk up and down the shoe-store aisle at least 20 times before deciding on the best fitting, non-returnable shoes.

“Okay, Cowboy, walk down the aisle,” I directed him during our recent visit to a shoe outlet.

He walked.

“If they hurt in the store, they will hurt later,” I repeated my mother’s mantra from my childhood days. “Do they feel good?”

“Yes,” Cowboy answered as he nodded.

“I don’t know,” I said to the salesman standing by, “does it look like his heels are slipping? He has skinny heels, like I do.”

“I wasn’t watching his heels.”

“Cowboy, walk the runway again for me.”

Again, he walked.

“I don’t see any slipping,” the patient young employee said.

“Do you see anything slipping, Flash?”

“Only your mind.”

I got on the loudspeaker and took a poll among other customers. “Good afternoon, shoppers. Please turn your attention to the young man in the blue and green shoes on the left side of the store.”

People turned around to watch Cowboy.

“Please raise your hand if it looks like his heels are slipping,” I instructed, as Cowboy took yet another stroll.

No hands went up.

“Thank you, my people. We have a winner!”

Since we were buying two pairs for Cowboy that day, we repeated the process. A few customers hurriedly left the store, shooing their children in front of them.

Knowing the shoes would be unreturnable after the first wear, Flash threw away the receipt when we got home.

But what if those new shoes break tomorrow? It was a horrible thought - broken footwear is the saddest of all. In 53 years, never once has a pair of shoes broken sooner than 12 months later. You never know, I reasoned as I dug through the trash, found the receipt, and dropped it into the tax box.

And so it goes. Every year, my tax-return box is cluttered with millions of receipts that aren’t pertinent to the IRS. I categorized and paper clip them into little piles, then label them with yellow Post-It notes. It’s a delicate process.

When I’m ready to itemize my deductions, I always have questions – the same questions I have every year. I could write the answers down for the next year’s return, but I’d miss my annual tax chat with Mom, the Human Resources Representative at Flash’s workplace, and my friend Sue who works for a CPA. I have three phone-a-friend chances and use them all.

After decades of watching me file paper returns, my too-organized friend, Vanessa, preached, “You should do your taxes with a software program.”

“I don’t need that newfangled stuff. I do it all on paper.”

“It’s faster. And it asks you questions so you won’t miss anything.”

“I don’t miss anything; I work hard to see my money return to me.”

Alexander Graham Bell had an easier time convincing dyed-in-the-wool tin-can-and-string users to try his telephone, than she had changing my mind.

I enjoyed gathering tax forms and the thick 1040 instruction booklet from the local library. During my eight hours of prep time, I kept Columbo or Dick Van Dyke Show episodes on a continual feed, day and night. The IRS was my bed partner; Flash slept in the guest room so I wouldn’t have to move paper piles off our bed. During the filling-in-forms phase, I spent two to four hours doing worksheets, looking up instructions that I forget every year, and entering numbers. Finally, it was done - my rough draft, in pencil.

I reviewed it at least seven times, prayed for mercy, burned a few candles, and copied my work onto clean forms, in ink. The signing of the 1040 was likened to that of the Declaration of Independence, in my mind. I could hear “Yankee Doodle” as I walked to my mail box for the last step of my tax return.

I opened and closed the mail box approximately eight times to make sure I was ready to walk away from my labor of necessity. It was a fine accomplishment every year.

But sometimes, aging is the mother of reinvention. I was getting tired of the 13 hours spent on tax returns each year. Maybe I should try that software this year, I told myself. I called Vanessa and told her I was ready. Of course, I did my return on paper first, to test the calculations of the supposed brilliant software. I had to see if its numbers matched mine. As I started on my maiden voyage to the Land of Electronic Returns, I worried my cyber CPA would forget a detail, leave out a question, or hurry me.

Then, the magic began. Topics I’d never heard of started popping up on my screen. I read about each one and filled in information where needed. In the upper right-hand corner, I could see my refund amount increasing. It was exhilarating.

I glanced at my paper return. The numbers were different, which, of course, made me nervous. I checked my math. I checked my entries on my laptop. I checked the phase of the moon. Still, the electronic return was ahead.

An hour and a half later, I conceded victory. My state-of-the-art return had won the competition; my refund was higher than if I’d stuck with my old-fashioned ways.

This year, I’ve further improved my tax return system. By throwing away all shoe receipts this week, I’ve streamlined my filing system. My new cardboard box is larger and sturdier than previous ones. My tax prep still takes eight hours, but electronic filing saves me five. Soon, I’ll power up my laptop and enter my scribbled numbers; it’s the perfect combination of old school and new. In no time at all, I’ll click on “File,” be reunited with my family, and go on with my life. Until next January.